The following information came directly from a post on EnergySage.com.

“The best states to go solar aren’t always the sunniest; those who benefit the most from installing a solar PV system for their home spend a lot in electricity and live in a state with good solar incentives.

Illinois may not have the year-round sunshine of the Southwest, but it does have a great solar market because of the available financial incentives. In addition to the 30 percent federal solar tax credit for solar system owners, Illinois residents can receive additional financial benefits through the state’s solar renewable energy certificate (SREC) market.

Solar incentives in Illinois

Illinois has a renewable portfolio standard (RPS) that commits the state to produce 25 percent of its electricity from renewable energy by 2025. Of that 25 percent, 1.5 percent must come from solar. Solar panel system owners can sell the SRECs that their panels produce alongside their electricity in order to help the state meet the solar requirement. This is why the renewable energy that Illinoisans produce has a monetary value in addition to offering savings on electricity bills.

In the past, the Illinois Power Authority (IPA) bought SRECs in “procurement rounds.” Solar system owners would typically sell their SRECs through an aggregator who acts as a broker between property owners and the state. These brokers will pay property owners for their SRECs on a quarterly basis over the course of five years, and sell the SRECs to the IPA during the specified procurement rounds. With the new SREC program, it’s a bit different – the current SREC program lasts for a longer duration, and the price you receive for each SREC is fixed and dependent on your utility company, system size, and how soon you go solar.

FEJA and the Adjustable Block (AB) Program

In 2017, the Illinois government created new legislation that altered the existing REC program structure in the state. The Future Energy Jobs Act (FEJA) took effect on June 1, 2017. This legislation is designed to stimulate job creation in clean energy, assist in the state in meeting its ambitious RPS goal by 2025, and promote energy efficiency.

FEJA includes a proposed new incentive structure known as the Adjustable Block (AB) Program. Rather than the old five-year SREC program in Illinois, this new incentive structure lasts for 15 years worth of solar production. The SRECs are sold at a fixed price which is determined by contracts, rather than the variable market prices of the old SREC program.

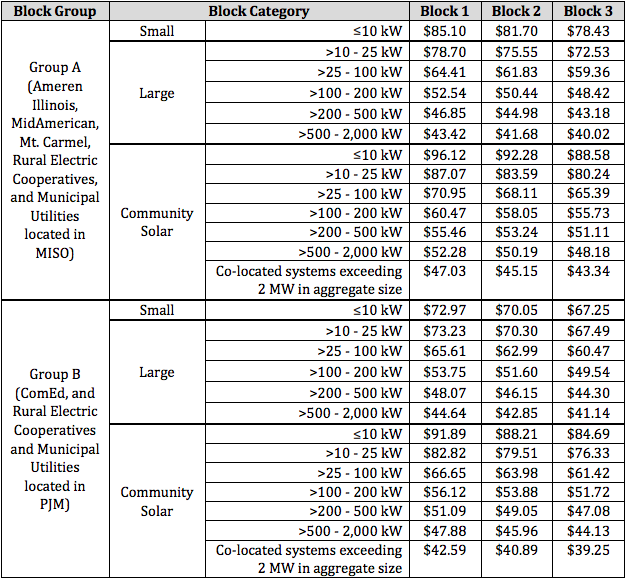

The AB Program uses a “block” structure to determine the value of an SREC. The state set a specific amount of installed solar (in megawatts) and an associated SREC price for each block. Once that amount is reached in a set block, the incentive will transition to a new block with a lower price. The result is that, as more people install solar, there are fewer funds available for the incentive. The block you’re eligible for depends on a multitude of factors:

- Capacity: As blocks fill up, the price for one SREC will decline.

- Type of project: Community solar is eligible, but for different values than systems located on your property

- Size of your solar installation: Incentive values are categorized based on size (systems under 10 kW, 10-25 kW, 25-100 kW, and so on).

- Utility company: You’ll be placed into a specific block depending on your electricity distributor and your load zone.

Below is an image of the current blocks and pricing information from the Illinois Power Authority.

Here’s an example to help you interpret the proposed pricing. Let’s assume you own a 7 kW system that produces 8 SRECs each year, and you are a customer of Ameren. Under the Adjustable Block Program, if you go solar while there’s still capacity in block 1, your 8 SRECs a year would sell for about $85 each. You’ll earn roughly $680 in SREC sales each year. If you install solar after block 1 fills up, you’ll be enrolled in block 2. Each of your 8 SRECs would sell for about $82, or $660 for each year.

The pricing is fixed for 15 years; while a solar panel system may experience degradation throughout the years and produce slightly fewer SRECs overall, the number of dollars that each SREC sells for will remain the same.

This incentive structure is very similar to the Megawatt Block rebate available in New York State, as well as the SMART incentive in Massachusetts that will replace their current SREC incentive and likely to be implemented later this year.”